YEAR

|

AMORTISED COST AT THE START OF THE

YEAR

(A)

|

EIR

(B) = (A) * 10.2626%

|

CASH FLOW

(C)

|

AMORTISED COST AT THE END OF THE YEAR

(D) = (A)+ (B) – (C)

|

1

|

100,000

|

10,263

|

6,000

|

104,263

|

2

|

104,263

|

10,700

|

8,000

|

106,963

|

3

|

106,963

|

10,977

|

10,000

|

107,940

|

4

|

107,940

|

11,077

|

12,000

|

107,017

|

5

|

107,017

|

10,983

|

118,000

|

0

|

Saturday, December 29, 2012

AMORTISED COST CALCULATION: THE EFFECTIVE INTEREST RATE (EIR)

Tuesday, December 4, 2012

Sunday, December 2, 2012

ICAI ENTREPRENEURSHIP CELL

Thursday, November 8, 2012

Friday, November 2, 2012

A prayer to my GOD..

Dear God,

So far I've done all things right..

I haven't gossiped

haven't lost my temper,

haven't been greedy, grumpy, nasty, selfish, or overindulgent.

I'm really glad about that..

But in a few hours, God,

And from then on, I'm going to need a lot more help..

Please be with me always

Yours,

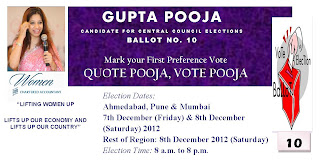

Gupta Pooja

♥ ♥

Tuesday, October 30, 2012

An Appeal

|

| An Appeal |

Chartered Accountant by qualification;

Teacher by profession; Author by choice..

Growing together, beautifully

Saturday, July 7, 2012

New Schedule VI – Generally Asked Questions & Answers (GAQA)

Wednesday, June 27, 2012

Ten Minutes - Revised Schedule VI (Part 2/3)

Thursday, May 10, 2012

Ten Minutes - Revised Schedule VI (Part 1/3)

Friday, January 20, 2012

TRUE & FAIR: HOW MUCH?

While reading through the annual report of one of the listed company (TRF Ltd – A Tata Enterprise) in India my attention was drawn to a small paragraph in the ANNEXURE TO NOTICE - Explanatory Statements pursuant to Section 173(2) of the Companies Act, 1956. Although, the paragraph was concise but it provided enormous information on the company’s profitability.

Reasons for loss or inadequate profits:

The financial mis-statements were noticed in a particular division for earlier years. This was done by a group of officers who were discharged from the Company and Company has initiated necessary legal proceedings against them. A new team, who had taken charge of the division had reviewed the costs of the projects under execution and corrected the same where ever necessary. Consequently, the Company had to book losses in the division bringing down the overall profits of the Company.

This paragraph quite evidently mentions “mis-statements” by group of officers in a division. The company has initiated legal proceedings against them. Is it an indication by the company that money has been siphoned off by this group of officers or alternatively can we believe that the company has detected fraud in this division?

The highlights section in the annual report throws light on the profitability.

Consolidated PBT 2009- 10: 7,387 lakhs Rupees

Consolidated PBT: 2010- 11: 712 lakhs Rupees

Fall in profits by: 90.36%

The company has a functioning audit committee since 1997 which meets the representative of internal auditors (Big 4 company) and statutory auditors (another Big 4 company) regularly. To any one’s guess what is discussed regularly in such meeting with representatives of Big 4s.

The auditor’s report (Big 4 is a statutory auditor) states that:

Based on our audit and on consideration of the reports of other auditors on separate financial statements and on other financial information of the components, and to the best of our information and according to the explanations given to us, in our opinion the Consolidated Financial Statements give a true and fair view in conformity with the accounting principles generally accepted in India

Few questions which I do not know who will answer:

Did the auditors not detect the fraud when the company initiated legal action against a group of officers of a particular division?

Did the auditors not read the annual report of the company?

Did the auditors not find the drop in profitability compared to earlier year by 91% alarming and material?

What was the corporate governance from the audit committee’s perspective?

Who is answerable to the present shareholders of the company?

And finally;

HOW MUCH TRUE & FAIR WERE/ ARE THE FINANCIAL STATEMENTS AS OPINED BY THE AUDITORS?

For your reference and read as a case study of corporate governance link of the company annual report is attached.

Wednesday, January 4, 2012

The Companies (Accounting Standards) Amendment Rules, 2011

” 46A. (1) In respect of accounting periods commencing on or after the 1st April, 2011, for an enterprise which had earlier exercised the option under paragraph 46 and at the option of any other enterprise (such option to be irrevocable and to be applied to all such foreign currency monetary items), the exchange differences arising on reporting of long-term foreign currency monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements , in so far as they relate to the acquisition of a depreciable capital asset, can be added to or deducted from the cost of the asset and shall be depreciated over the balance life of the asset, and in other cases, can be accumulated in a “Foreign Currency Monetary Item Translation Difference Account” in the enterprise’s financial statements and amortized over the balance period of such long term asset or liability, by recognition as income or expense in each of such periods, with the exception of exchange differences dealt with in accordance with the provisions of paragraph 15 of the said rules.

(2) To exercise the option referred to in sub-paragraph (1), an asset or liability shall be designated as a long term foreign currency monetary item, if the asset or liability is expressed in a foreign currency and has a term of twelve months or more at the date of origination of the asset or the liability:

Provided that the option exercised by the enterprise shall disclose the fact of such option and of the amount remaining to be amortized in the financial statements of the period in which such option is exercised and in every subsequent period so long as any exchange difference remains unamortized.”

.jpg)